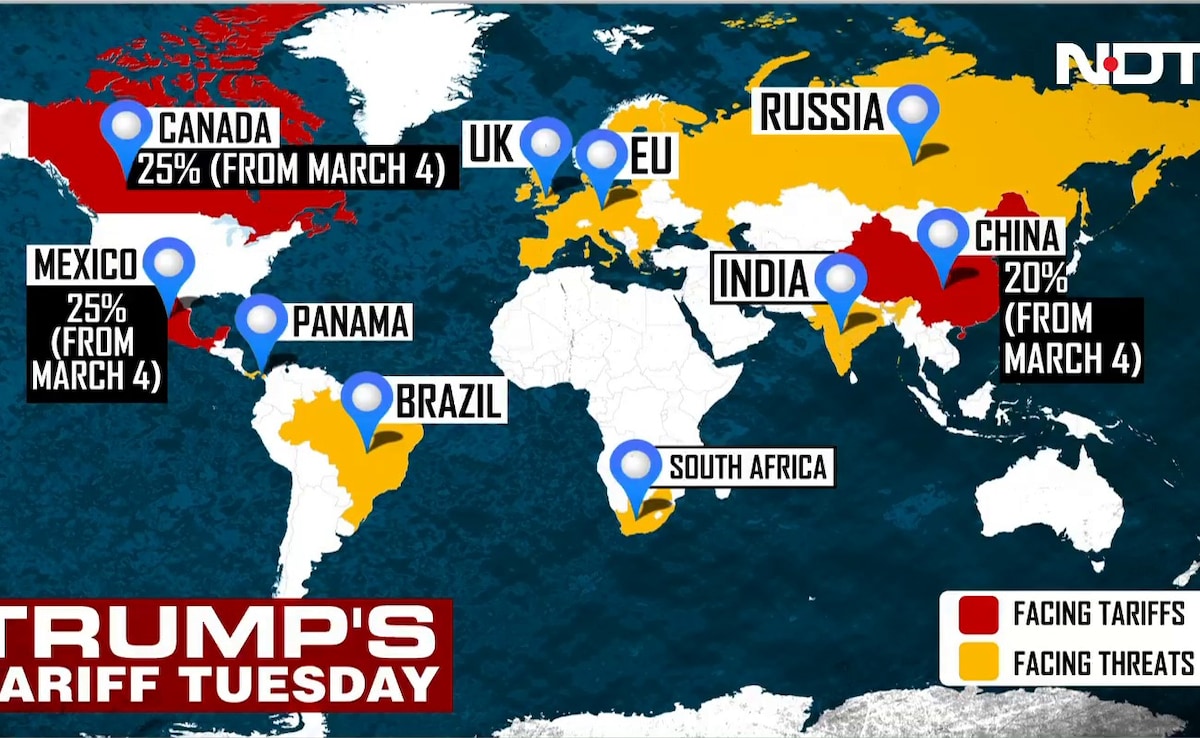

Global stock markets plummeted following US President Donald Trump’s confirmation that tariffs on imports from Canada and Mexico would be implemented, raising fears of a trade war. The 25% tariffs, effective Tuesday, are linked to border issues and the fentanyl crisis. Trump also announced an increase in tariffs on Chinese imports to 20%. The Dow fell by 649 points, while markets in Asia and Australia also declined. Canada and Mexico’s officials indicated potential retaliatory measures, and economists warned of severe impacts on North American supply chains and consumer prices, potentially impacting the global economy.

New Delhi:

Global stock markets experienced a sharp decline following remarks from US President Donald Trump, who confirmed that tariffs on imports from Mexico and Canada would proceed as scheduled. Trump’s declarations on Monday heightened concerns about a potential trade war in North America, causing turmoil in financial markets. US stocks plummeted significantly during late afternoon trading, and both the Mexican peso and Canadian dollar also saw declines.

The President announced that a 25 percent tariff on imports from Canada and Mexico would be implemented starting Tuesday after a 30-day pause linked to illegal border crossings and the influx of fentanyl into the US comes to an end. He also reiterated his intention to raise tariffs on all Chinese imports to 20 percent, up from the previous 10 percent, in response to Beijing’s failure to stop fentanyl shipments to the United States.

What Trump Said?

“They’re going to have to have a tariff. So what they have to do is build their car plants, frankly, and other things in the United States, in which case they have no tariffs,” Trump stated at the White House.

He added that there was “no room left” for any deal that would prevent the tariffs by controlling fentanyl flows into the United States.

Regarding the increase in tariffs on all Chinese imports, the President noted that Beijing “has not taken adequate steps to alleviate the illicit drug crisis.”

The tariffs are set to be enforced at 12:01 a.m. EST (0501 GMT) on Tuesday, as confirmed by the Trump administration in Federal Register notices. At that time, the US Customs and Border Protection agency will begin imposing a 25 percent tariff on goods from Canada and Mexico, along with a 10 percent duty on Canadian energy.

Trump has consistently asserted that tariffs are a valuable mechanism for addressing trade imbalances and supporting US manufacturing, dismissing worries that these actions may harm the US economy. This is particularly relevant in North America, where businesses have benefited from years of free trade.

CEOs and economists warn that Trump’s tariffs on Canada and Mexico, which cover over $900 billion in annual US imports, will significantly disrupt the highly integrated North American economy.

Canada, Mexico And China Respond

Mexico’s economy ministry announced that no public statement would be made until President Claudia Sheinbaum’s morning press conference on Tuesday. However, on Monday, Sheinbaum hinted at a message for Trump during a public appearance in Colima, stating that “Mexico has to be respected.”

She pledged to take action, asserting, “We have a plan B, C, D.”

Canadian Foreign Minister Melanie Joly addressed reporters, emphasizing that Ottawa is prepared to respond, but did not provide specifics.

Ontario Premier Doug Ford expressed to NBC that the US tariffs and Canada’s retaliation would result in “an absolute disaster” for both nations. “I don’t want to respond, but we will respond like they’ve never seen before,” Ford said, mentioning potential shutdowns at Michigan auto plants within a week and halting nickel shipments and electricity transmission from Ontario to the US.

“I’m going after absolutely everything,” Ford declared.

Meanwhile, China’s state-run Global Times reported that Beijing has organized countermeasures, likely aimed at targeting US agricultural and food products.

Markets Swoons

All three major US indexes declined following Trump’s comments. The Dow Jones Industrial Average fell 649.67 points, or 1.48 percent, the S&P 500 decreased by 104.78 points, or 1.76 percent, and the Nasdaq Composite dropped 497.09 points, or 2.64 percent. Additionally, a measure of the Magnificent Seven megacaps saw a 3.1 percent decline, while a UBS collection of US stocks negatively affected by tariffs lost 2.9 percent.

Asian and Australian markets also reflected these trends, with shares in Tokyo, Hong Kong, and Sydney decreasing. The benchmark Nikkei 225 index fell by 2.43 percent, and the broader Topix index dropped 1.48 percent.

In India, the Nifty index is anticipated to open nearly 1 percent lower as investors grow increasingly cautious about escalating geopolitical tensions and the likelihood of retaliatory tariffs intensifying the global trade conflict.

Automakers faced significant declines, with General Motors, which extensively produces trucks in Mexico, down 4 percent and Ford falling 1.7 percent.

Gustavo Flores-Macias, a public policy professor at Cornell University, indicated that consumers may start experiencing price increases within days.

“The automobile sector, in particular, is likely to face considerable negative consequences, not only due to the disruption of supply chains that span the three countries in the manufacturing process but also because of the anticipated rise in vehicle prices, which could dampen demand,” Flores-Macias explained.

Trump’s Plan For Reciprocal Tariff

In the previous week, Trump initiated a tariff investigation into countries that impose digital services taxes, suggested fees of up to $1.5 million each time a Chinese-built ship arrives at a US port, and launched a new tariff probe regarding copper imports.

These actions come in addition to his proposals for higher US “reciprocal tariffs” to align with the tariff rates of other nations and counterbalance their trade barriers, a strategy that could significantly impact the European Union due to the value-added taxes imposed by member states.

However, Trump’s “tariffs on steroids” may sustain elevated inflation levels and potentially drive the global economy toward recession, cautioned Desmond Lachman, a senior fellow at the conservative American Enterprise Institute.