A Ripple-BCG report forecasts that global asset tokenization will soar from $0.6 trillion in 2025 to $18.9 trillion by 2033, with Ripple leveraging XRP Ledger for enhanced cross-border payments. XRP recently recovered above the $2.00 mark, supported by a 1.4% rise in open interest, suggesting bullish momentum. Tokenization is evolving beyond cryptocurrencies into diverse financial instruments, enabling fractional ownership and instant settlements. The U.S. is leading this transformation, backed by favorable regulations. As XRP stabilizes, traders look for a move towards $2.25, amid macroeconomic pressures influencing market dynamics.

- A Ripple-BCG analysis forecasts that global asset tokenization will soar from $0.6 trillion in 2025 to an astounding $18.9 trillion by 2033.

- Ripple intends to utilize the XRP Ledger for efficient cross-border payments and settlements, thus enhancing XRP adoption.

- An increase of 1.4% in open interest to $3.08 billion, along with a favorable long/short ratio, indicates growing bullish potential.

- XRP has regained support above the 200-day EMA, with bulls aiming for a short-term price movement to $2.25 on Friday.

During the Asian session on Friday, Ripple (XRP) approached the significant $2.00 level following a slight correction the day before, which reinforced support at $1.95. A joint report by Ripple and Boston Consulting Group (BCG) details the current landscape of tokenization, anticipated growth over the next five to eight years, and why this is an opportune moment for early movers, including institutions, to accelerate and shape the market.

Ripple positions XRP as a bridge asset in the shifting tokenization landscape

According to the report titled “Approaching the Tokenization Tipping Point,” global finance has operated for decades on a fragmented, outdated infrastructure that lags behind the evolving needs of markets, clients, and capital.

Tokens have evolved from basic cryptocurrency units into diverse financial and non-financial instruments like securities, real estate, and funds, facilitating fractional ownership, real-time transfers and settlements, and adherence to regulatory standards.

The report predicts that the tokenization of real-world assets will escalate from $0.6 trillion in 2025 to a staggering $18.9 trillion by 2033, yielding a 53% compound annual growth rate. The United States is currently leading the charge in tokenization, including tokenized funds, treasuries, and collateral. The present administration under President Donald Trump is expected to further expedite this progress by advocating for clear regulations regarding digital assets.

Projected tokenization growth until 2033 | Source: Ripple-BCG report

In a landmark decision on Thursday, the President enacted a bill that prohibits the Internal Revenue Service (IRS) from gathering data for tax reporting from decentralized crypto platforms.

The Ripple-BCG report underscores that tokenization is more than just a technological trend; it’s the result of a combination of factors, including technological advancements and regulatory progress. This intersection creates a favorable landscape for adopting XRP as more institutions gravitate towards the digital asset economy, seeking blockchain solutions that promote sustainability and regulatory compliance.

“The transition to a tokenized economy is transforming financial assets from static entities into dynamic software. Tokenization is not merely a digital overlay or enhancement to the global financial system—it’s a fundamental redesign of the foundational layer that has supported financial institutions for years,” Ripple and BCG stated in the report.

XRP price stabilizes ahead of weekend rally

Even though the Relative Strength Index (RSI) is currently below a declining trendline, it has recovered from nearly oversold conditions to 43.62, signaling a rise in bullish momentum.

A daily close above the critical $2.00 threshold would validate XRP’s strengthening technical outlook, likely enticing more traders to enter the market. A breakout to $2.25, which aligns with both the 50-day EMA and the 100-day, is anticipated to follow.

XRP/USD daily chart

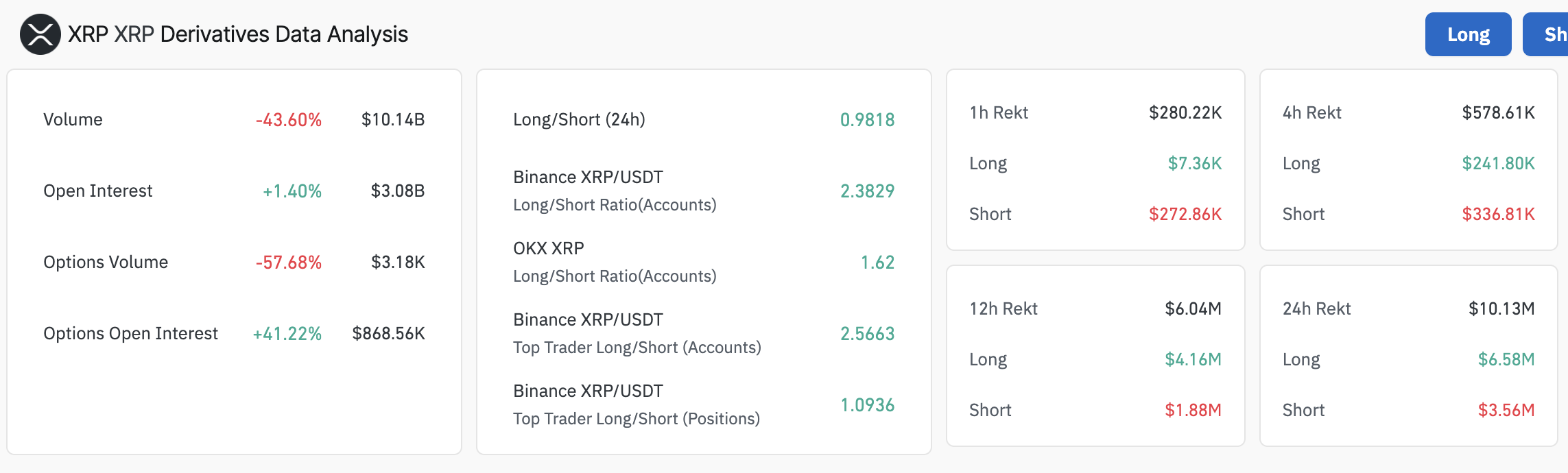

Analyzing liquidation data reveals an intriguing balance between long and short positions within the 4-hour timeframe. Long liquidations are notably lower at $241,800 compared to short liquidations at $336,810, suggesting that bears may be more susceptible to upward price movements of XRP. Meanwhile, a 1.4% rise in the open interest of derivatives to $3.08 billion points to increased capital inflow and an upbeat sentiment.

XRP derivatives analysis data | Source: Coinglass

XRP remains under a descending trendline resistance set from the yearly local high at $3.39, along with the 50-day EMA and the 100-day EMA, indicating ongoing bearish pressure that must be addressed for a sustainable upward trend.

Furthermore, the token is not insulated from macroeconomic pressures, particularly with escalating tariffs between the US and China. President Trump announced a pause on tariffs for 90 days on Wednesday; however, experts caution that the resulting negotiations could have extensive consequences, impacting XRP’s price performance.