On Monday, Wall Street saw several significant calls: UBS reiterated a sell rating on Tesla, lowering its price target to $225. Jefferies upgraded Airbnb to buy, citing durable growth prospects. Morgan Stanley maintained an overweight rating on Nvidia, identifying AI as a strong investment area. Mizuho initiated coverage of SanDisk as outperform, while Susquehanna upgraded Credo to positive. Piper Sandler upgraded Samsara, and Bank of America initiated Aardvark Therapeutics as a buy. Other notable upgrades included Shift4 Payments and Cracker Barrel. Citigroup upgraded several companies, including Xpeng and KeyCorp, while downgrading Sherwin-Williams to hold.

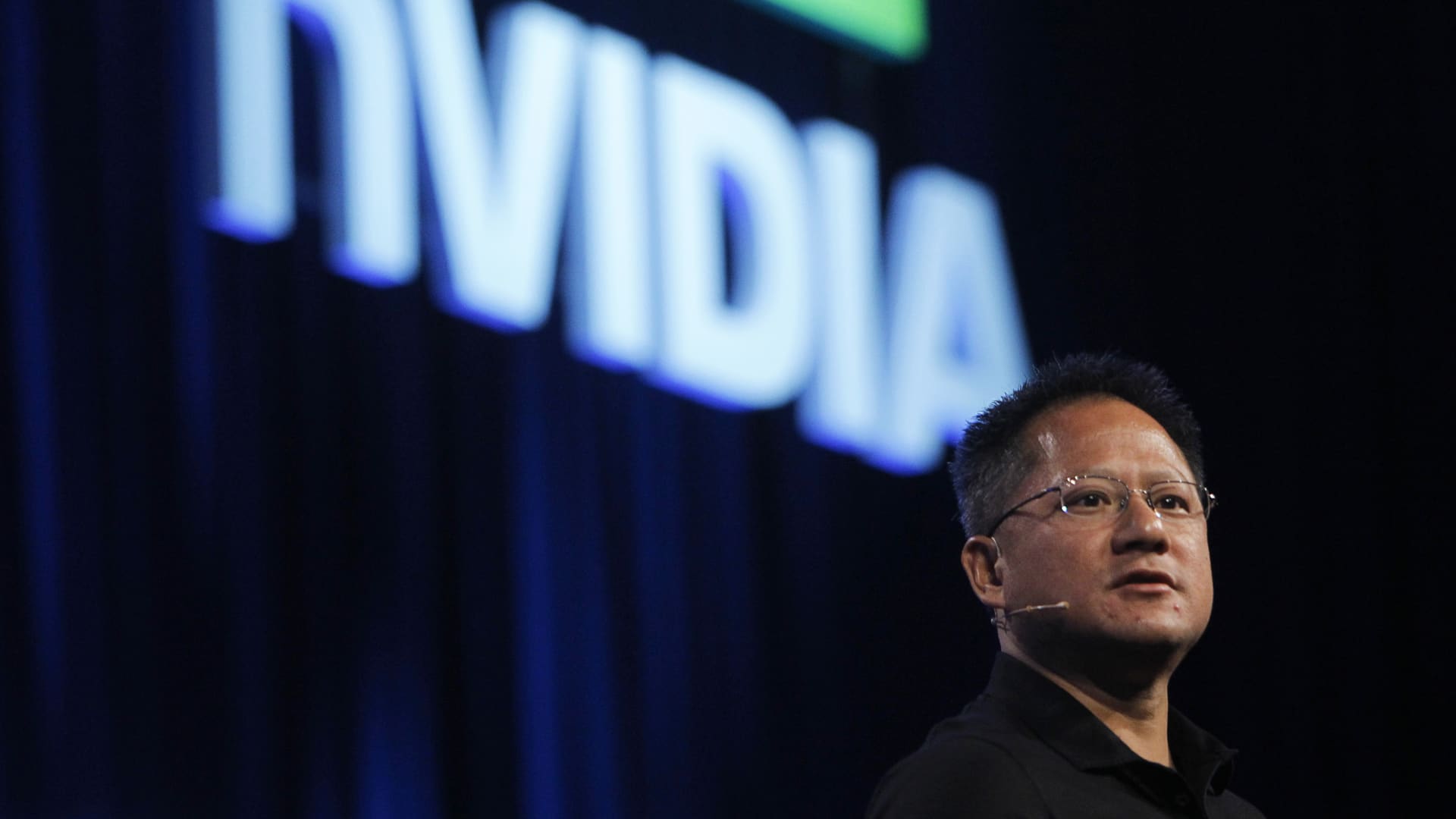

Here are the notable recommendations from Wall Street on Monday: UBS maintains sell rating on Tesla UBS has reduced its price target for Tesla to $225 per share from $259. “We are adjusting our 1Q25 delivery forecast down to 367k from the 437k we had set as a placeholder after the 4Q24 results.” Jefferies upgrades Airbnb to buy from hold Jefferies believes the online vacation rental firm will experience “durable growth.” “We anticipate that lodging market share gains will be complemented by enhanced adoption of experiences, an area where ABNB is positioned to excel.” Morgan Stanley reaffirms overweight rating on Nvidia The firm remains confident in Nvidia as a leading investment. “There is a persistent positive industry outlook; despite general investor skepticism, AI investment continues to be a bright spot for semiconductors, while we observe a slow bottoming phase in analog. Company wafer fab equipment [WFE] estimates are more optimistic than ours. We maintain our NVDA Top Pick…” Mizuho starts SanDisk with an outperform rating Mizuho believes the data memory hardware firm is well-positioned for market share expansion. “We are initiating coverage of SNDK with an Outperform rating and a $60 price target.” Susquehanna raises Credo’s rating to positive from neutral Susquehanna upgraded the data infrastructure solutions provider, citing compelling stock valuation. “We initiated coverage on Credo last December with a Neutral rating, citing concerns over its high valuation, despite a compelling AI networking narrative. With shares down 50% from peak and fundamentals improving, we are revisiting our assessment with this upgrade.” Piper Sandler upgrades Samsara to overweight from neutral Piper Sandler sees the fleet management and industrial applications provider as “high quality” and “durable.” “After a 40% stock price correction over the past few weeks and more than 20% in the last six months, we are upgrading shares to OW from Neutral.” Bank of America starts coverage on Aardvark Therapeutics with a buy rating Bank of America sees the biopharma firm as well-positioned. “We begin coverage of Aardvark Therapeutics (AARD), a company focused on metabolic diseases, with a Buy rating and $22 price objective.” Raymond James boosts Shift4 Payments to strong buy from outperform The firm believes the fintech payment company is positioned well following its acquisition of luxury payment provider Global Blue. “We are upgrading FOUR to Strong Buy from Outperform and adding it to our Analyst Current Favorites list after the recent price drop (-29% compared to S&P Mid-Cap 400 -7% since the 4Q print) and following an increased appreciation of the Global Blue acquisition alongside our view that the initial 2025 outlook is conservative.” Rosenblatt reinstates Super Micro Computer as buy The firm highlights Super Micro Computer’s competitive edge in delivering liquid cooling at scale. “We are reinitiating coverage of Super Micro Computer (SMCI), also known as Supermicro, with a $60 price target for the next 12 months.” Barclays downgrades Emerson Electric to underweight from equal weight The firm predicts worsening industrial capital expenditures. “The longer-cycle nature of capex means any recovery here will likely lag behind that of ‘early cycle / residential’ demand, as well as short-cycle industrial demand, which is one key reason we prefer those exposures. We believe EMR is most at risk.” Citi upgrades Xpeng to buy from neutral Citi reports robust volume growth for the China EV manufacturer. “We upgrade to Buy based on strong volume growth projected for 2025/26, robust order intake, new model launches, a projected earnings turnaround in 2026, and potential growth drivers in AI and robotics.” Truist raises Cracker Barrel’s rating to buy from hold Truist sees the restaurant chain in the midst of a turnaround. “We are upgrading our rating on CBRL to Buy from Hold and raising our estimates and price target to $55, up from $51, following strong F2Q25 results.” Citi begins coverage on Karman with a buy rating Citi lauds the defense contractor’s unique position. “We initiate coverage of KRMN with a Buy rating and a 12-month price target of $42. The company is ideally placed between defense primes and traditional suppliers in the defense ecosystem, capable of leveraging its engineering expertise and material science proficiency to provide products/sub-systems at lower costs than customers can achieve independently.” Morgan Stanley names Sallie Mae a new top pick The firm sees upward momentum for the student loan company. “Investor discussions have revolved around whether a federal reduction in student loans will come to pass, and how quickly this could benefit SLM. While it has given back some gains recently, the stock has performed reasonably well so far this year, up 8% while coverage is down 3% and the S&P 500 is down 2%.” Wells Fargo initiates Knife River with an overweight rating The firm sees margin improvements for the construction materials and contracting firm. “With exposure to high-growth states with aging infrastructures and a favorable industry environment, we expect strong tailwinds for KNF.” Citi upgrades KeyCorp to buy from neutral Citi highlights the banking stock’s attractiveness at present levels. “Following the recent sector pullback, we find an attractive entry point for KEY and are upgrading to Buy as the stock ranks among the best values on our implied cost of equity valuation metrics.” Jefferies downgrades Sherwin-Williams to hold from buy Jefferies observes a potential “demand shock” stemming from U.S. policy for the paint company. “Compared to the S&P 500, Sherwin-Williams trades in line with the 10-year average: we believe increasing caution regarding demand prospects may result in a relative discount. Investor conversations indicate that both the pro-cyclical share gain strategy and the solid balance sheet and FCF profile are well recognized.” Citi reiterates buy rating on Apple The firm has removed its positive catalyst watch while maintaining its buy recommendation on Apple. “We are concluding our catalyst watch dated 1/31 to account for a delay in the highly anticipated Siri upgrade as part of the iOS 18.4 update in April.” Bank of America begins coverage of SailPoint as buy The firm identifies the company as a “strong force in a growing cybersecurity sector.” “We are initiating coverage of Identity Security vendor SailPoint with a Buy rating and a $27.50 price objective, indicating a potential upside of 25%.” Raymond James enhances CME Group’s rating from market perform to outperform The firm believes the financial services and exchange entity is well-positioned “in a turbulent global macroeconomic and geopolitical context.” “We are upgrading CME Group to Outperform from Market Perform and establishing a $287 target price.”